In 2024, the issue of leaked credit cards has become a pressing concern for consumers and businesses alike. With the rise of digital transactions and online shopping, the potential for credit card information to be compromised has never been higher. Reports indicate that data breaches are becoming more sophisticated, leaving countless individuals vulnerable to fraud and identity theft.

This article delves into the world of leaked credit cards, exploring how these leaks occur, the consequences they carry, and the essential steps you can take to safeguard your financial data. We aim to equip you with the knowledge needed to navigate the complexities of online security and protect your hard-earned money.

As we move forward, understanding the dynamics of leaked credit cards in 2024 will not only help you stay informed but also empower you to make proactive decisions regarding your financial safety. Join us as we explore this critical topic in depth.

Table of Contents

- 1. What Are Leaked Credit Cards?

- 2. How Do Credit Card Leaks Occur?

- 3. The Impact of Leaked Credit Cards

- 4. How to Protect Yourself from Credit Card Leaks

- 5. What to Do If Your Credit Card is Leaked

- 6. Case Studies: High-Profile Credit Card Leaks

- 7. Future Trends in Credit Card Security

- 8. Conclusion

1. What Are Leaked Credit Cards?

Leaked credit cards refer to instances where sensitive credit card information, including card numbers, expiration dates, and security codes, are exposed to unauthorized entities. This information can be sold on the dark web, leading to financial theft and fraud. Understanding the nature of these leaks is crucial for anyone who uses credit cards for transactions.

2. How Do Credit Card Leaks Occur?

2.1 Common Methods of Data Breaches

Data breaches can occur through various methods, including:

- Hacking: Cybercriminals often use sophisticated techniques to breach company databases and steal credit card information.

- Malware: Malicious software can be implanted onto devices to capture personal information when users enter their credit card details.

- Physical Theft: Stolen devices, such as smartphones or laptops, can lead to unauthorized access to stored credit card information.

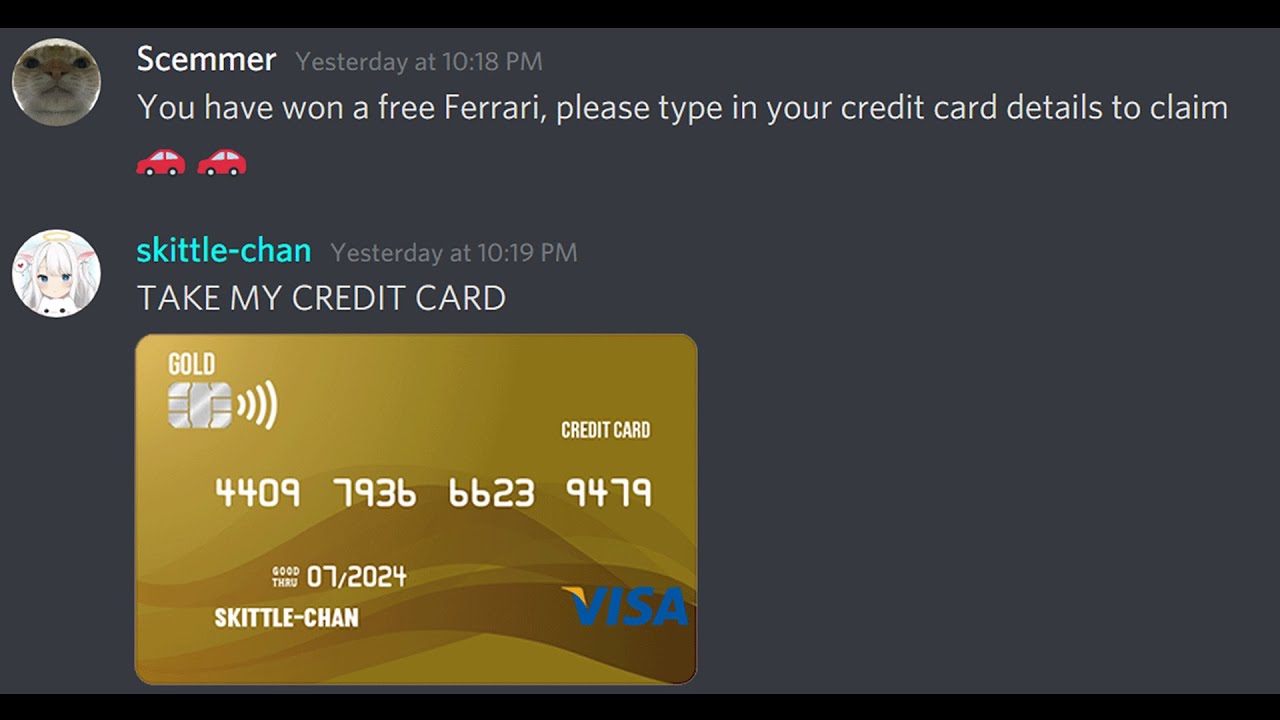

2.2 The Role of Phishing Scams

Phishing scams are deceptive tactics used by cybercriminals to trick individuals into revealing their credit card information. These scams often come in the form of fraudulent emails or messages that appear legitimate. Users may be directed to counterfeit websites that mimic real companies, leading to unintentional disclosure of sensitive data.

3. The Impact of Leaked Credit Cards

The fallout from leaked credit cards can be catastrophic for both consumers and businesses. Victims may face unauthorized transactions, identity theft, and long-term damage to their credit scores. For businesses, the consequences can include legal ramifications, loss of customer trust, and significant financial losses.

4. How to Protect Yourself from Credit Card Leaks

4.1 Best Practices for Online Security

To mitigate the risks of credit card leaks, consider the following best practices:

- Use strong, unique passwords for each online account.

- Enable two-factor authentication whenever possible.

- Regularly update your software and devices to patch security vulnerabilities.

4.2 Monitoring Your Financial Accounts

Stay vigilant by regularly monitoring your financial accounts. Look for any unauthorized transactions and report them immediately. Additionally, consider enrolling in credit monitoring services that can alert you to suspicious activity.

5. What to Do If Your Credit Card is Leaked

If you suspect that your credit card information has been leaked, take immediate action:

- Contact your bank or credit card issuer to report the incident.

- Request a credit freeze or fraud alert on your credit report.

- Monitor your statements for unusual activity and dispute any fraudulent charges.

6. Case Studies: High-Profile Credit Card Leaks

Throughout history, there have been several notable cases of credit card leaks:

- Target Data Breach (2013): Over 40 million credit card numbers were compromised during a security breach.

- Equifax Data Breach (2017): Personal information of 147 million consumers was exposed, leading to widespread identity theft.

7. Future Trends in Credit Card Security

As technology evolves, so do the methods for securing credit card information. Emerging trends include:

- Enhanced encryption techniques to protect data.

- Adoption of biometric authentication methods.

- Implementation of blockchain technology for secure transactions.

8. Conclusion

Leaked credit cards are a growing concern in our increasingly digital world. By understanding the risks and implementing effective security measures, you can protect yourself from potential fraud and financial loss. Stay informed, monitor your accounts, and take proactive steps to safeguard your credit card information.

We encourage you to share your thoughts in the comments below, and don’t hesitate to explore more articles on our site for additional insights into financial security and consumer protection.

Thank you for reading! We hope you found this article informative and valuable. Remember, staying informed is the first step in protecting your financial future.

Joe Cole: Exploring The Life Of The Actor And His Wife

Samantha Beckinsale: A Comprehensive Insight Into Her Life And Career

Exploring John Ratzenberger's Net Worth: A Comprehensive Analysis